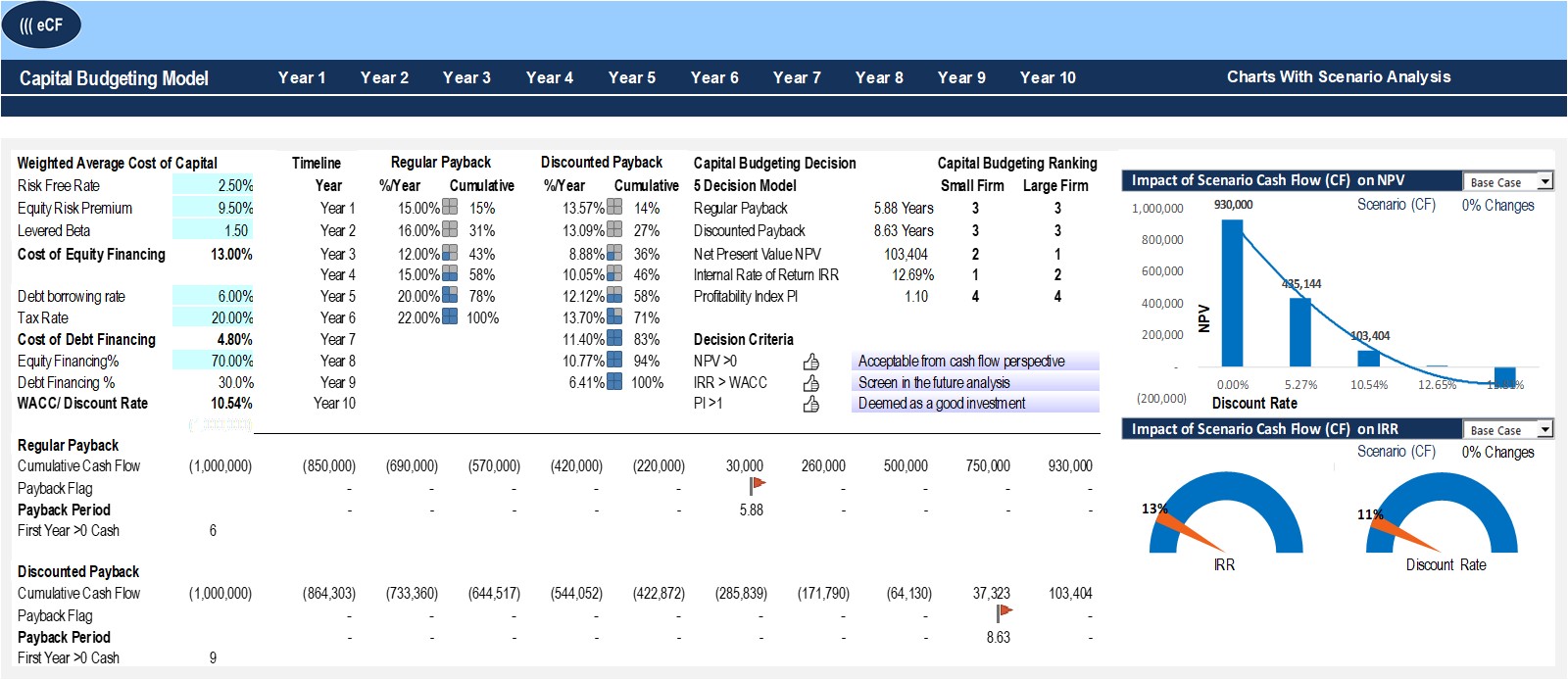

The project is expected to generate $110,000 in cash revenue annually for ten years. After subtracting variable and fixed cash expenses, the project generates $50,000 in net cash flow (before taxes) each year. When a firm is presented with a capital budgeting decision, one of its first tasks is to determine whether or not the project will prove to be profitable. The payback period (PB), internal rate of return (IRR), and net present value (NPV) methods are the most common approaches to project selection. It is important to note that net cash inflow is not the same as net operating income, although they are similar. Net cash inflow only includes cash revenues, cost savings, and cash expenses.

Financial Planning & Capital Budget

Annual revenue is estimated to be $36,000 and annual cash operating expenses are estimated to be $12,000. It is important to emphasize that the analysis in Exhibit 11-8 who files schedule c: profit or loss from is based on the estimates and projections given in the original data in Exhibit 11-2. Assume that the manufacturer provided each model’s estimated useful life.

- The premium model requires maintenance service in year 2, year 4, and year 6 at a cost of $2,100 per service.

- In addition, a company might borrow money to finance a project and, as a result, must earn at least enough revenue to cover the financing costs, known as the cost of capital.

- The data in Exhibit 11-2 gives net operating income, which includes depreciation expense.

- For instance, finding suitable payroll services can be challenging if you have one employee.

Methods Used in Capital Budgeting

The cost of capital is usually a weighted average of both equity and debt. The goal is to calculate the hurdle rate or the minimum amount that the project needs to earn from its cash inflows to cover the costs. To proceed with a project, the company will want to have a reasonable expectation that its rate of return will exceed the hurdle rate. With present value, the future cash flows are discounted by the risk-free rate because the project needs to earn that amount at least; otherwise, it wouldn’t be worth pursuing. Ideally, businesses could pursue any and all projects and opportunities that might enhance shareholder value and profit.

Capital Budgeting: Definition, Methods, and Examples

Capital budgets often cover different types of activities such as redevelopments or investments, whereas operational budgets track the day-to-day activity of a business. Payback periods are typically used when liquidity presents a major concern. If a company only has a limited amount of funds, it might be able to only undertake one major project at a time. Therefore, management will heavily focus on recovering their initial investment in order to undertake subsequent projects. A bottleneck is the resource in the system that requires the longest time in operations. This means that managers should always place a higher priority on capital budgeting projects that will increase throughput or flow passing through the bottleneck.

What is the approximate value of your cash savings and other investments?

There is every possibility that shareholders will derive the maximum benefit, which in turn results in wealth maximization. In the case of fixed assets, these refer to assets that are not intended for resale. Examples include land and buildings, plant and machinery, and furniture. Thus, it is a process of deciding whether or not to commit resources to a project whose benefit would be spread over the years.

Payback analysis is the simplest form of capital budgeting analysis, but it’s also the least accurate. It is still widely used because it’s quick and can give managers a “back of the envelope” understanding of the real value of a proposed project. Column A is for the year or years in which the cash inflow or outflow occurs. A lump sum is a single receipt or cash payment in the future entered as a single year. Compute the payback period and simple rate of return for both machines. The B model would cost $360,000, generate $180,000 in annual cash revenues, and $60,000 in annual cash operating cost.

The annual net cash inflows are positive since this is the net cash received from the investment. The useful life for the Diamond LX and VIP Express models are 12 and 10 years, respectively. Accordingly, the discount factor is selected from the present value of an ordinary annuity table.

This enables them to maximize shareholder wealth, which is the basic objective of each company. If there are wide variances, then a revised capital budget may be necessary to provide additional resource appropriation. Capital budgeting represents the plans for appropriations of expenditure for fixed assets during the budget period.

It enables businesses to identify projects whose cash flow exceeds the cost of capital. For instance, if a project costs $600,000 as an initial investment and the project will generate $60,000 in revenue each year, the payback period is ten years. Payback analysis is the amount of time it takes to recover the cost of an investment. It’s the simplest form of capital budgeting but also the least accurate.

The data in Exhibit 11-2 gives net operating income, which includes deprecation expense. When net operating income is provided, depreciation expense is added back to arrive at net cash inflow. The initial investment covers the costs of buildings, equipment, and working capital.