Then when earnings are higher, the corporation will increase spending for personnel and get caught up on the maintenance it had put off. Get new tipps on retirement savings, investment decisions and antifraud tipps. The larger names would book billions of apartment sales each year, often with only a small deposit having been paid.

Business Strategy

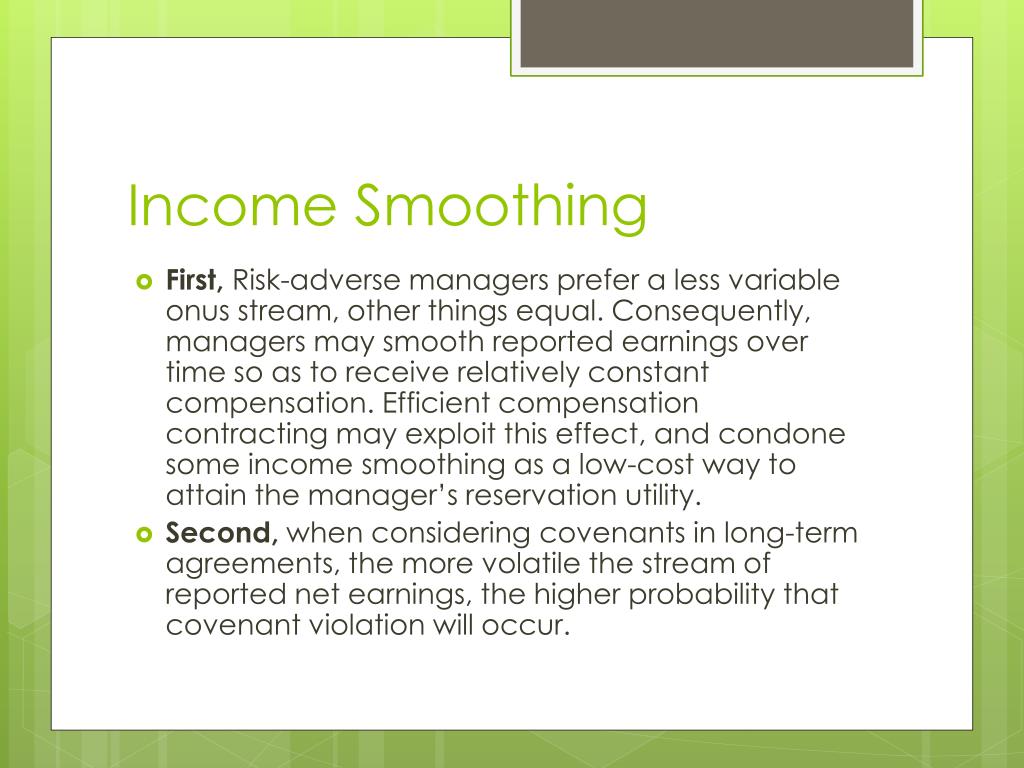

These practices allowed Enron to present a consistent pattern of earnings growth, deceiving investors and analysts. Financial stability is crucial for the success and sustainability of any business. Income smoothing is a financial strategy that involves managing and adjusting a company’s reported earnings to achieve a more stable and predictable income stream. In this article, we will explore the concept of income smoothing and its benefits. It is more likely that the term income smoothing is used to mean reporting misleading earnings, creative accounting, and aggressive interpretation of accounting principles and concepts. Perhaps a company increases its allowance for doubtful accounts with an increased bad debts expense only in the years with high profits.

Income Smoothing: Unleashing the Power of Financial Stability

Manipulating financial results can be seen as a violation of accounting standards and securities laws. Companies found engaging in aggressive income smoothing may face regulatory investigations, fines, and reputational damage. Suppose PQR Ltd., an electronics company, experiences high sales and profitability during the year due to increased demand for its innovative home appliances. To ensure a more consistent financial portrayal, the company strategically sets aside a portion of its profits (say 8%) instead of reporting them entirely within the current fiscal period. This reserved profit acts as a buffer, allowing the company to adjust the financial books during the less prosperous years to present a stable income trend to investors and stakeholders.

Timing of Revenue Recognition

Of course, the assets created by capitalization needed to be depreciated but this was a great way of deferring the costs of failed investments. An accounting method where revenue and expenses are recorded when they are earned or incurred, regardless of when cash is exchanged. Following discussions with industry bodies and a thorough review of shareholder experience, the company concluded that discontinuing income smoothing is in the best interest of shareholders. Future payments will now be based on accrued income from the respective share class during the payment period, with no income being held back. Depending on the country, companies pay a progressive corporate tax rate; meaning that the higher the income earned, the higher the taxes paid. To avoid this, companies may increase provisions set aside for losses or increase donations to charities; both of which would provide tax benefits.

The Enron snowball

While it may seem like a harmless strategy, income smoothing can have significant implications for investors, regulators, and the overall stability of the financial system. Enron used off-balance-sheet entities and complex accounting techniques to manipulate its reported earnings and hide its true financial condition. The company created special purpose entities (SPEs) to keep debt off its balance sheet and inflate its earnings.

- A firm that can show consistent returns from year to year is more likely to attract investors who feel more at ease when they see steady returns over a longer time period.

- The reductions in fluctuations can result from some legitimate business methods to fraudulent ones.

- But it’s a fine line between taking what the Internal Revenue Service (IRS) allows and outright deception.

- However, if employed to manipulate financial statements or deceive stakeholders, it becomes unethical and may breach accounting standards.

Income smoothing is an accounting practice used by companies to reduce the fluctuations in their reported earnings over time. By adjusting the timing of revenue and expense recognition, firms can create a more stable financial performance picture, making it easier for investors and analysts to assess their ongoing profitability. This practice raises questions about accounting quality and can be a form of earnings management when used excessively or misleadingly. Income smoothing is the shifting of revenue and expenses among different reporting periods in order to present the false impression that a business has steady earnings.

Then in a year with low profits, the company will reduce the allowance for doubtful accounts and greatly reduce bad debt expense. Moreover, implementing strong internal controls, independent audits, and fostering an ethical financial management culture within the organization can further help prevent such practices. One way companies can smooth their income is by manipulating the timing of revenue recognition. They may choose to recognize revenue earlier or later than usual, depending on their desired earnings pattern.

Management typically engages in income smoothing to increase earnings in periods that would otherwise have unusually low earnings. The actions taken to engage in income smoothing are not always illegal; in some cases, the leeway allowed in the accounting standards allows management to defer or accelerate certain items. In other cases, the accounting standards are clearly being sidestepped in an illegal manner in order to engage in income smoothing. Income smoothing is a common practice used by businesses to reduce the variability of earnings and create a more stable financial picture over time. While it is legal when done ethically and in compliance with accounting standards, businesses must exercise caution to avoid engaging in fraudulent practices.

Income smoothing, also known as earnings management, is the process of intentionally altering a company’s financial results to create a more stable pattern of earnings over time. The goal is to reduce the volatility of reported earnings, making income smoothing describes the concept that them appear more consistent and predictable to investors and stakeholders. Income smoothing is a financial practice that involves manipulating a company’s reported earnings to create a more consistent and predictable stream of income.

Companies can also manipulate their reported earnings by adjusting reserves and provisions. By increasing or decreasing these accounts, companies can smooth out their income over time. For example, a company may increase its provision for bad debts in a good year to offset potential losses in the future.

While income smoothing can offer benefits, it has also been subject to criticism. Critics argue that smoothing earnings can distort the true financial picture of a company and make it difficult for investors to assess its actual financial health and performance. Deferred accounting is a fundamental concept in financial reporting that involves the recognition of revenue and expenses at a later date rather than when the corresponding cash flow occurs. A deferral is recorded in the income account only sometime after payment or receipt has occurred.